The North American machine vision market is down 8 per cent to $1.3bn over the first half of 2020 compared to the same period in 2019, according to the Association for Advancing Automation.

The robotics market in North America is down 18 per cent so far compared to the same period last year. Order revenue for robotics totalled $716m, which is also down 18 per cent.

These figures mirror predictions from the VDMA Robotics and Automation, which expect a drop in sales of robotics equipment in Germany of at least 20 per cent in 2020.

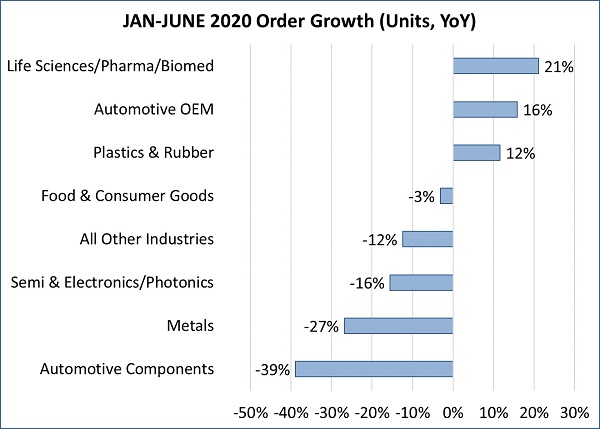

The only three sectors showing positive growth for robotics in North America were: life sciences, including pharmaceuticals and biomedical, which was up 21 per cent; automotive OEM, which grew 16 per cent; and plastics and rubber, up 12 per cent.

Sales of robots into automotive component production in North America fell by 39 per cent, while those to semiconductor and electronics production fell by 16 per cent.

Jan-June 2020 order growth for robotics. Credit: A3

'It’s clear that our industry is feeling the effects of Covid-19, its strain on supply chains, and the overall economic uncertainty due to our current circumstances,' said Alex Shikany, A3 vice president, membership and business intelligence. 'Despite the numbers reflecting these recent challenges, our latest market surveys tell us that there is optimism for what the next six months will bring.'

When asked about the next six months, 42 per cent of A3 vision and imaging members believe sales will increase moderately (between 1 per cent and 10 per cent), while 17 per cent believe sales will increase by more than 10 per cent. Twenty seven per cent of vision respondents believe there will be further decreases, while 15 per cent expect sales to remain flat.

Machine vision components, consisting of cameras, lighting, optics, imaging boards, and software, fell 9 per cent to $174m over the first half of 2020 in North America. Machine vision systems, including application specific machine vision (ASMV) and smart cameras, fell 8 per cent to $1.1bn.

Leading machine vision firms, including Cognex, Stemmer Imaging and Isra Vision, all posted a decline in turnover this year. Basler is the only vision firm to buck that trend, up 9 per cent for the first half of 2020.