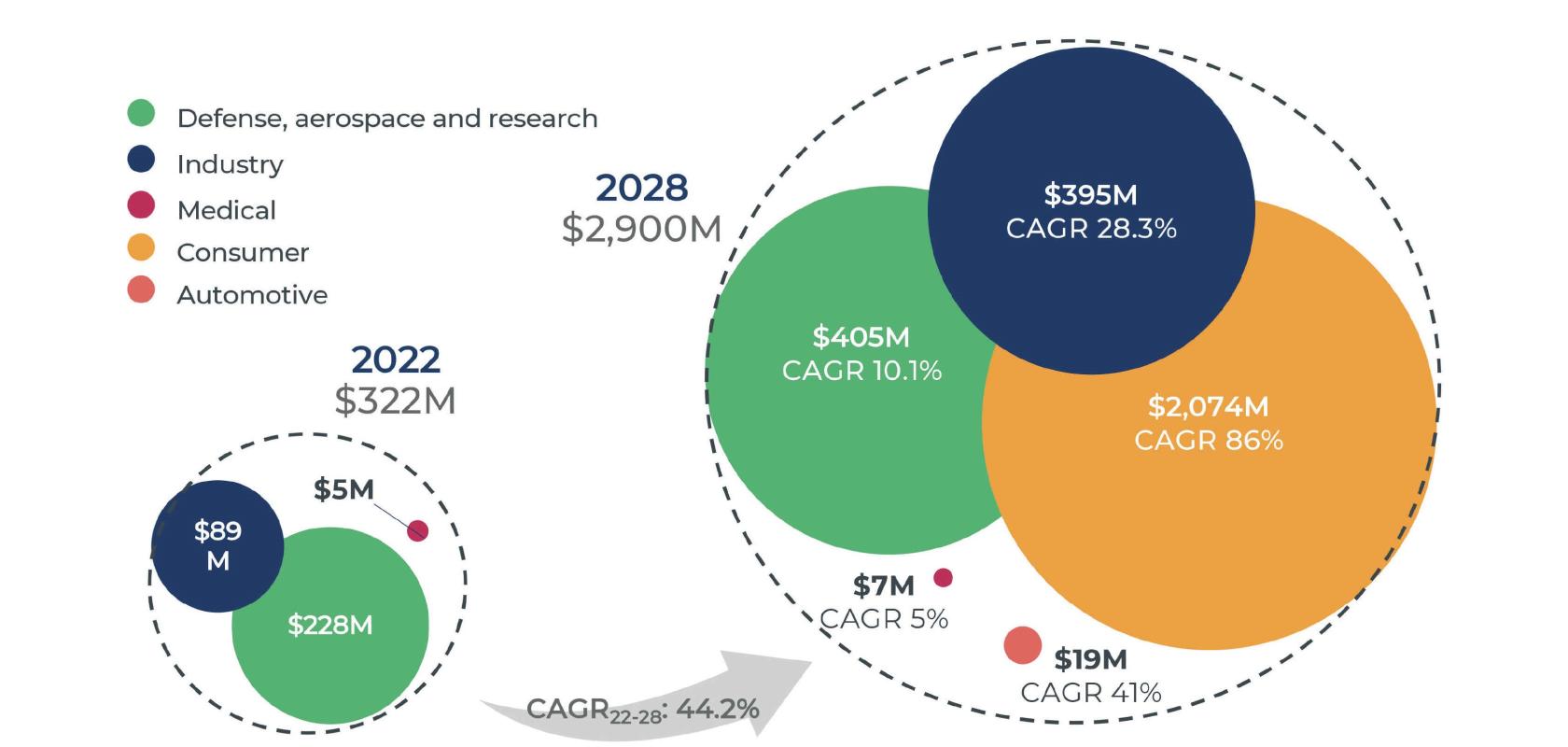

Driven by increasing demand in the industrial, defence and consumer sectors, the SWIR imaging market is expected to reach approximately $2.9 billion in 2028.

Such is the main takeaway from Yole Intelligence’s recent SWIR Imaging 2023 market report.

The industrial segment, powered by steady demand and price reductions, will grow at a CAGR of 28% over the next five years, reaching $395 million in 2028.

Meanwhile the defence segment will experience higher growth than the firm previously anticipated, set to grow from $228 million in 2022 to $405 million in 2028, at a CAGR of 10%. This will be driven by geopolitical tensions such as the Ukraine war, tensions around Taiwan and an increasing number of countries becoming interested in SWIR technologies.

The much more modest automotive segment, set to reach just $19 million by 2028, at a CAGR of 41% will be driven by ADAS, where SWIR provides vision capability in low light and harsh conditions and 3D-sensing capability.

The consumer segment is by far the largest overall, set to grow at a staggering CAGR of 86% to $2.07bn by 2028. Yole anticipates that SWIR could be integrated into lower-end smartphones and AR/VR headsets to increase performance of tracking cameras, 3D sensing, and even multispectral imaging in outdoor conditions.

“In 2026, SWIR can start replacing NIR imagers in flagship smartphones for under-display integration of facial recognition modules. This will drive a $2,074 million market by 2028, considering the complete 3D-sensing modules,” said Dr Axel Clouet, Technology and Market Analyst, Imaging at Yole Intelligence.

In terms of SWIR imaging suppliers, the market intelligence firm has identified those serving the lucrative defence market as being leaders in the field. For example, SCD is currently top of the board, followed by Sensors Unlimited and Teledyne FLIR. Other players such as Sony, or companies making quantum-dot-based cameras (e.g. SWIR Vision Systems and Emberion), which have a price advantage on high-resolution and extended spectral range products, show significant growth potential. Newcomers bringing disruptive technologies to the SWIR imaging market, particularly in the consumer and automotive segments, include STMicroelectronics, TriEye, and Artilux.

The report also cites Sony and STMicroelectronics as being the only traditional CMOS image sensor suppliers having currently developed SWIR imaging technology, with Samsung and OmniVision also beginning to show signs of interest. With their high-volume production capacity and unique design and integration know-how, such firms could be “game changers” to the SWIR imaging market, according to Yole.

“The SWIR ecosystem waits for greater interest from these players to accelerate technological and market disruption,” the firm said in its announcement of the report.