During April and June, the European Machine Vision Association conducted a two-part survey on the effects the Covid-19 pandemic could have on the machine vision industry, based on a questionnaire and telephone interviews with senior managers. The results are described below

This EMVA survey tried to represent as wide a cross-section of the vision industry as possible, with participants from both EMVA member companies and from the wider industry. The majority of participants expect a U-shaped economic development during and after the crisis. On average the survey participants anticipate the machine vision industry to contract by 17 per cent in 2020. Customer industries related to health along with food manufacturing are expected to benefit from the crisis, while automotive is seen as the sector to suffer most.

Machine vision supply chains are not yet severely in danger. Working from home is proving to be an efficient tool to maintain business operations, whereas trade shows and other business meetings are dearly missed. Although Covid-19 certainly places serious constraints on the overall economic outlook for many machine vision enterprises, participants of the survey also identified possible opportunities arising from the global crisis.

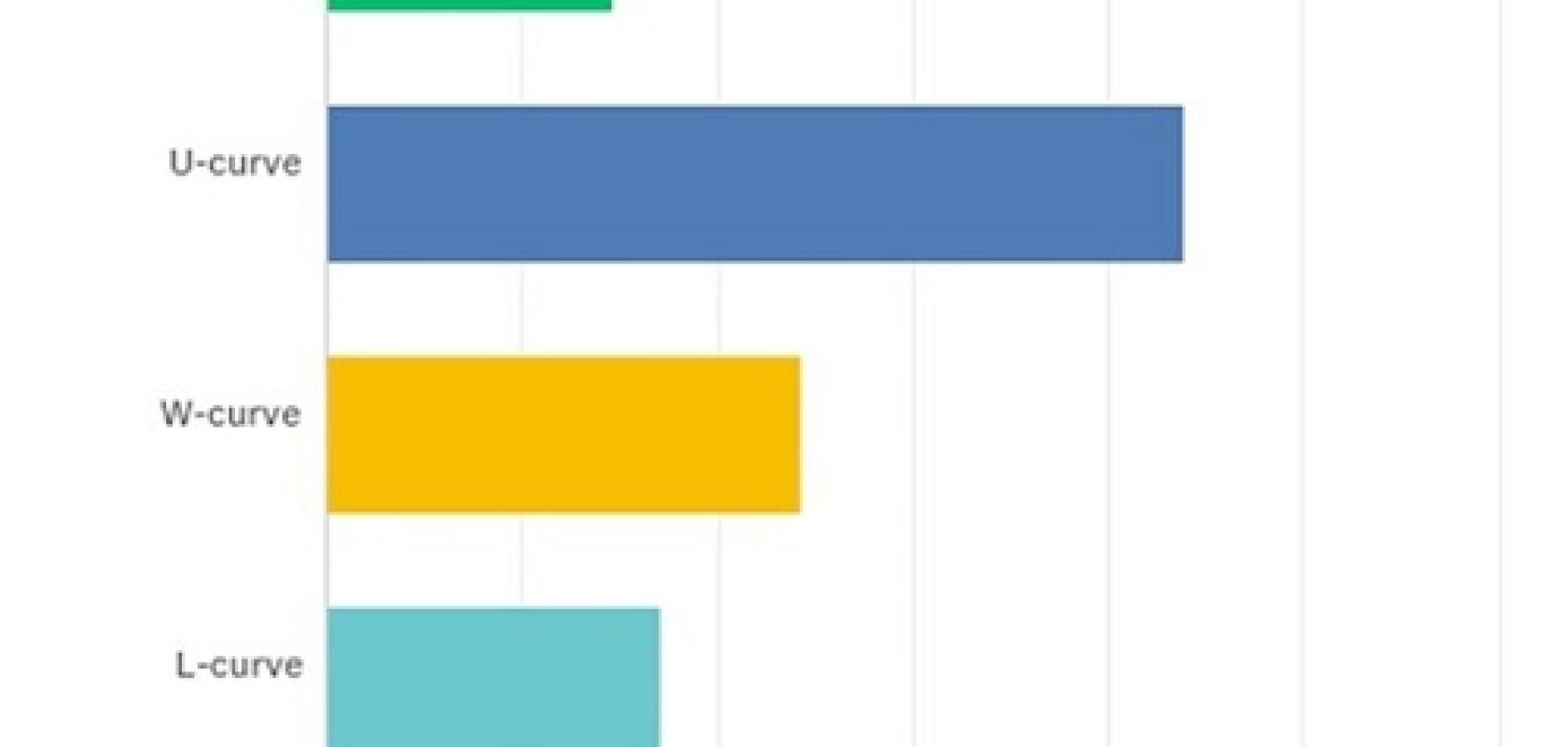

At the time the answers were provided, the impacts of the Covid-19 pandemic were not the same across the world. However, a dominant concern within the machine vision industry was about future economic development. Almost 44 per cent of respondents anticipate a U-shaped curve with a strong economic decline, a lasting period of recession, and a strong recovery only at the end; 24 per cent expect a double-dip W-recession caused by, first, catch-up investments after the lockdown, followed by a slow-down because of missing order income during the lockdown period, and a possible threat of a second coronavirus infection wave. Seventeen per cent expect a strong decline with no signs of fast recovery (L-curve), and 15 per cent believe in a strong and fast recovery after a sharp recession (V-curve).

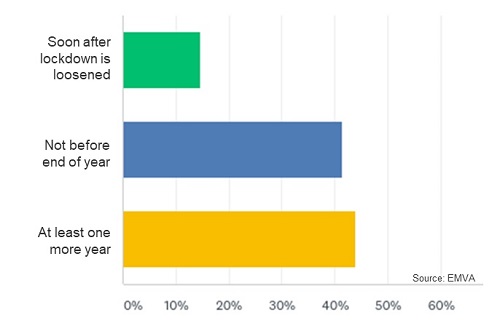

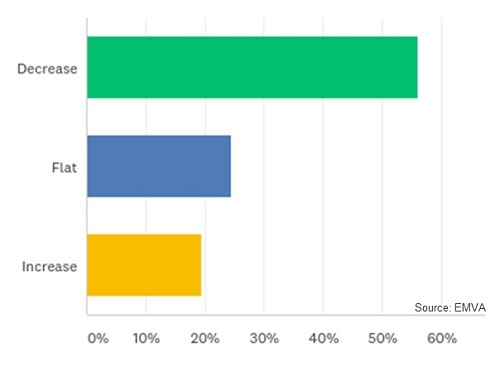

It was noted by component manufacturers and distributors that, after the pandemic reached its peak in April, customers ordered twice or more the amount of products they normally would in case of future stock and supply chain problems. However, the majority of participating companies believe that pre-crisis sales levels will not be reached before the end of 2020, or even one year after the peak of the crisis this spring. Asked about their personal business expectations, 56 per cent of companies stated that Covid-19 has resulted in a net contraction of their business.

Most of the companies approached were cautious about the second half of 2020 and expected a drop in demand for this period. Even those who generally experience strong sales to the Asia-Pacific region are sceptical, since many consumer goods produced in the region may not find buyers in the western markets because of restrained consumer spending. On average the survey participants expect the machine vision industry to contract by 17 per cent in 2020.

When will the machine vision industry return to pre-crisis sales levels?

Although countries such as Italy, Spain, the UK and France were hit much harder by Covid-19 than others there were no uniform statements that the drop in machine vision sales directly correlated with the intensity of how affected a particular country was. One explanation is that orders were still placed while people were working from home, which enabled a base level of business continuity.

Another question in the survey was how long an individual company could survive a lockdown period as seen in March and April. Here, more than 80 per cent of the companies stated that their enterprise would survive six months or longer until a lockdown would ultimately threaten their survival, a strong statement of the underlying strength of businesses within the machine vision sector.

Customer industries: winners and losers

The most affected industry vertical identified by the survey participants was the automotive sector. However, part of the picture at closer examination is also the fact that the shutdown of automotive production lines offered ways for vision system integrators to bring installations forward in time, where during normal operation only small slots of line standstill are available. This provided contracts to integrators during the first shutdown period. Other industries strongly affected include the machine building industry and the area of sports and entertainment. Furthermore, parts of the glass industry were hit by closed restaurants and bars with less demand for glass bottles.

What are your personal business expectations during and immediately after Covid-19?

The main customer industries that the survey participants expect to feel no impact, or even benefit from the coronavirus pandemic, are medical devices, healthcare and life sciences, followed by the pharmaceutical and cosmetics industry, the food and beverage industry – where several participants indicated that sales even increased thanks to higher demand for automated farming and food production – and logistics and postal sorting.

Supply chains in danger?

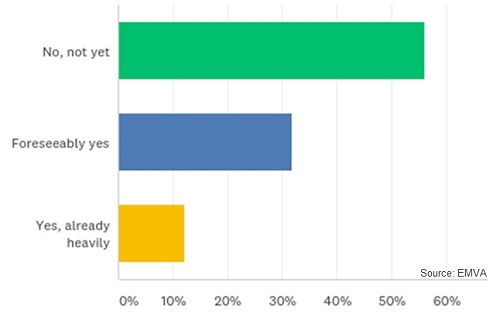

Another issue during the current situation is the stability of supply chains, potentially impacted by closed borders and reduced air traffic. At the time of answering, 56 per cent said that their supply chains were not yet in danger; but another 31 per cent stated that they could have difficulties with supply chains, and 12 per cent said that the coronavirus crisis had already heavily impacted on the supply of components.

Disruptions in the supply chain were also reported in direct interviews. Shortages and delays in delivery mainly in general electronic components and industrial PCs coming from China were reported because of the extension of the Chinese New Year break into March. Additionally, shipment costs from Asia rose due to lack of transport space in China, Korea and Singapore. Long lead times are expected when demand increases and reduced production capacities may not be able to support the sudden increase in demand. By way of example, companies in France reported that a large logistics provider stopped collection and delivery of parcels for almost all of April.

Overall these situations may lead to companies rethinking their supply structure and further diversify by building up alternatives in different countries.

Are your supply chains affected by Covid-19?

Working from home a success

One remarkable finding of the interviews was the almost unanimous opinion how efficient working from home has been, with the participants saying that the majority of staff were fully functional after a short transition period. In addition, most people interviewed stated that travel to suppliers and customers has been successfully replaced by video conference tools, saving both time and money. Staff also benefited from less commuting between home and office. It is therefore thought that even after the current restrictions are eased, many of these new digital meeting tools will remain.

Of course, these new habits do not fully replace personal visits to a customer, the on-site expertise given by integrators, or even cultural habits of face-to-face meetings and dinner invitations.

Trade shows are also missed. 'No trade show means no new contacts', and 'virtual shows are one thing, but you need to see the product live', together with 'we are humans and want to interact personally' were statements summarising the fear that with no active new business development on trade show floors the lack of new leads could contribute to a drop in sales in the second half of the year. But not everyone approached was missing trade shows, as some companies also benefit from earlier concentration of their customer interaction through the internet and tools like search engine optimisation.

Do you think the vision industry can eventually benefit from the impacts of Covid-19, such as through faster implementation of automation and digitisation?

Opportunities for vision technology

'Any event like this forces change', and 'we look at the crisis as an opportunity' are two statements given about how Covid-19 might impact the companies in the machine vision industry. One opportunity is what an interview partner described as a 'seeding period' in R&D, meaning there is an opportunity to concentrate resources on R&D projects and to invest in innovation while day-to-day business is slower.

The biggest opportunities are seen in the acceleration of production flexibility, through robotics and process and factory automation, where vision plays a role in the digitalisation of factories. But in order to profit from these opportunities it was also stated that the vision industry must present itself as an enabler of higher profitability.

Another side-effect of the lockdown and closed borders could also be relocation of production analogous to the reshoring movement in the USA several years ago. This applies, for instance, to the pharmaceutical industry in France and Germany, which now seeks to relocate production from Asia to their home countries – an opportunity also for the machine vision industry since quality inspection is a key element in producing pharmaceuticals.

No matter where in the vision value chain a company is, one advice from an interview partner is probably applicable for all enterprises: 'The corona crisis must be taken as an opportunity for all companies to scrutinise their business model and efficiency.'

Get in touch

Please let us know how you are coping with the current situation. What are you most concerned about; how are your organisations aiming to deal with the effects of Covid-19? greg.blackman@europascience.com