The online UK supermarket Ocado has bought two North American robotics companies to enhance robot picking in its warehouses and expand its client base.

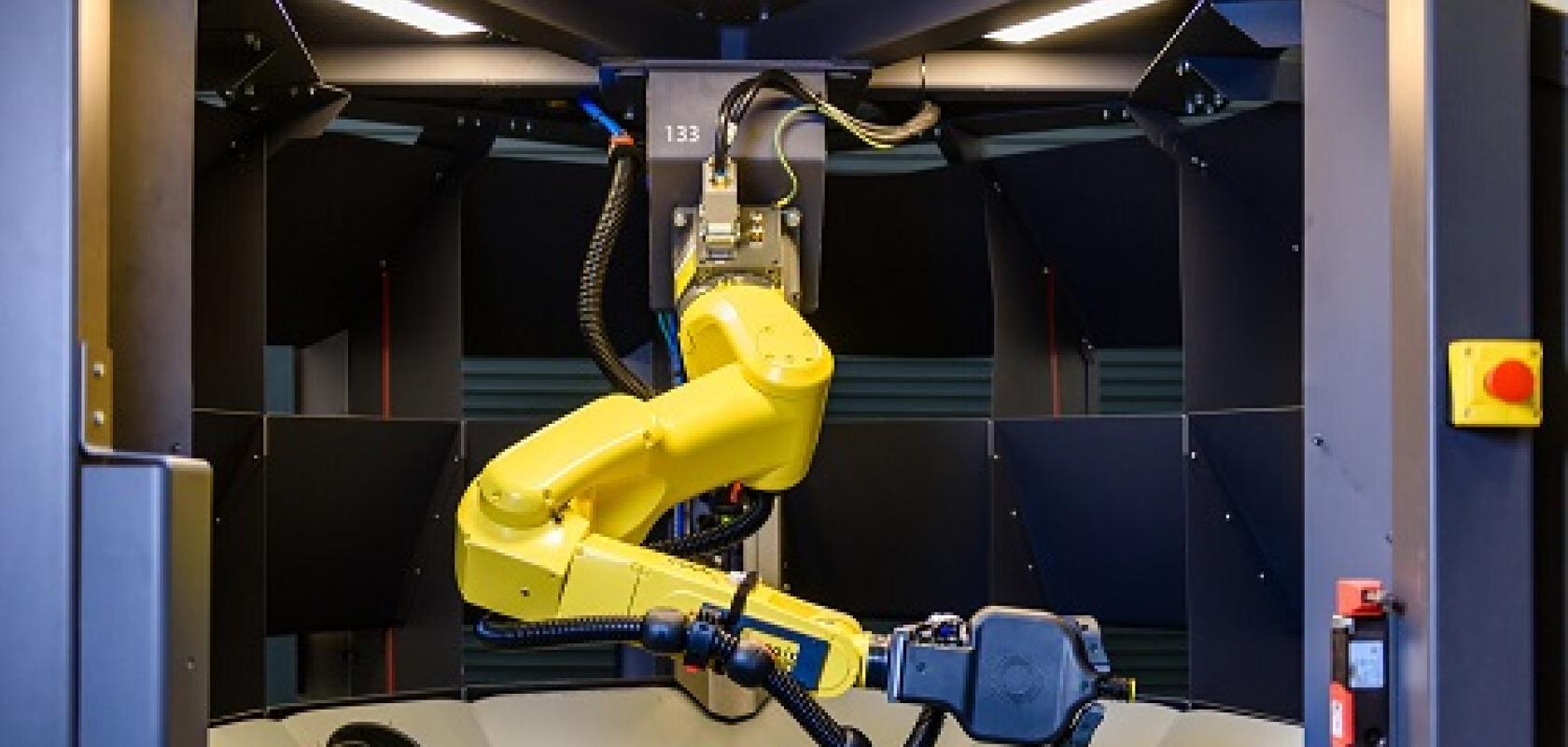

Ocado purchased piece-picking robot firm Kindred Systems for $262m, and Haddington Dynamics for $25m. Haddington Dynamics is an R&D company building robot arms.

Founded in 2014, Kindred Systems uses what's called deep reinforcement learning – a form of artificial intelligence that improves the learning process of handling disparate items like those in grocery – to develop piece-picking robots with AI-powered vision and motion control.

Tim Steiner, CEO of Ocado group, commented: 'I am delighted to be welcoming Kindred Systems and Haddington Dynamics to the Ocado group, as we believe they have the capabilities to allow us to accelerate delivery, innovate more, and grow faster. I am also excited by the opportunity to enter new markets for robotic solutions outside of grocery that is demonstrated by Kindred Systems’ robust growth, with existing customers such as Gap and American Eagle across the general merchandise and logistics sectors.'

In June, clothing retailer Gap purchased 73 of the Kindred's Sort units, on top of the 33 already installed, to keep up with the surge in online shopping and physical distancing requirements caused by the pandemic. In August, another leading apparel brand, American Eagle Outfitters, also expanded its fleet of Sort robots by two dozen units.

In October, Kindred reported that its robots picked a combined total of 100 million retail units since market launch in 2017.

Kindred Systems has around 90 employees, approximately half of whom are engineers who will join Ocado's technology team, and the remainder driving Kindred Systems' growth. The company is expected to have approximately 180 robots installed and operating by the end of 2020, and is expected to generate revenues of $35m in the 2021 calendar year.

Ocado expects full year 2021 revenues to increase as a result of the two acquisitions by approximately £30m, with a small negative impact on EBITDA.

Ocado said that, given the significant costs associated with the decant and picking functions within customer fulfilment centres (CFC) – it puts the annual cost per CFC at up to £7m – automation solutions have attractive economic potential for both Ocado and its partners.

Further uses within CFCs, such as de-palletising and de-trashing, and in other applications, such as food handling and vertical farming, may also be possible over the medium term, Ocado said.