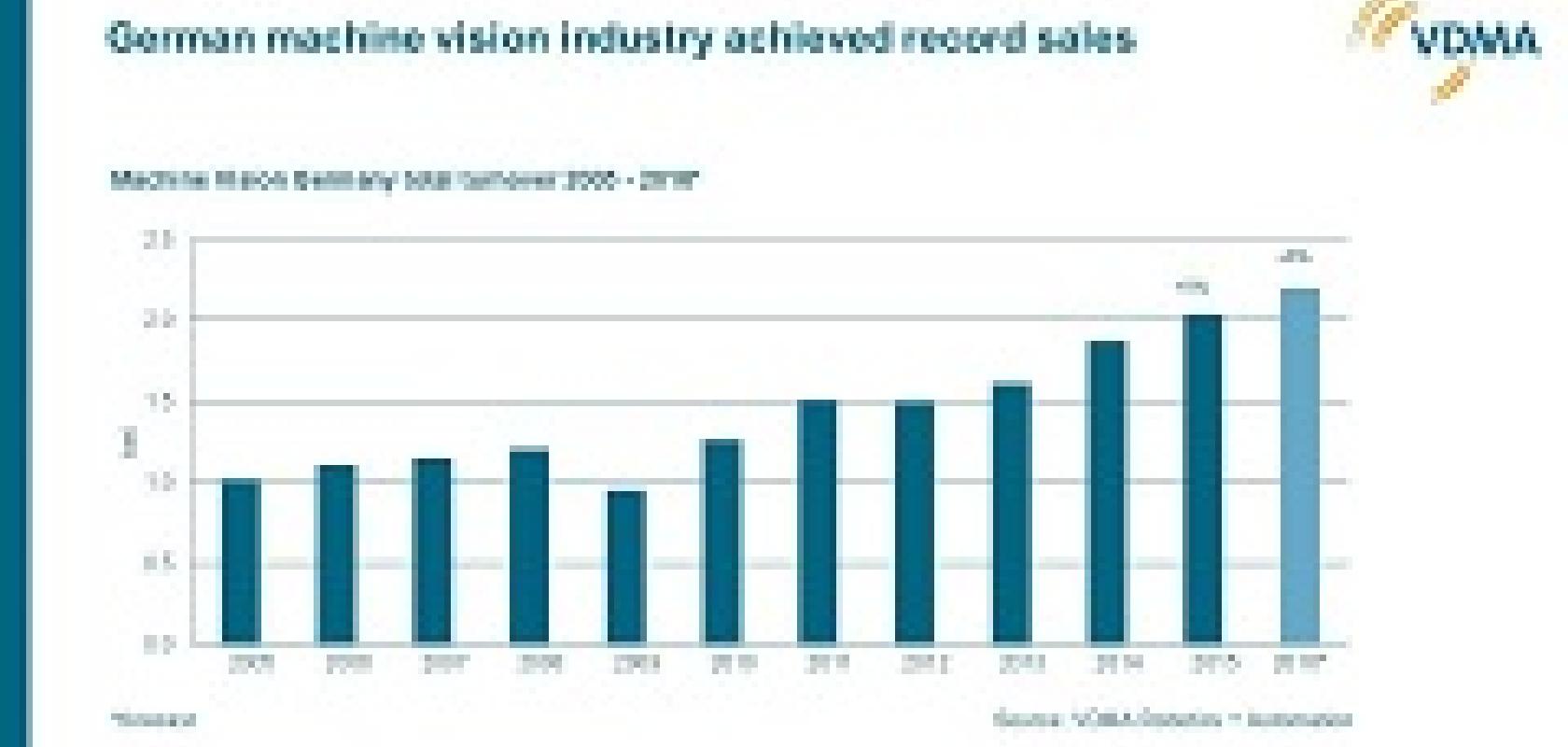

The German machine vision industry achieved record sales of €2 billion in 2015, according to new data from VDMA Machine Vision. Turnover increasing by nine per cent compared to the previous year.

Industry sales have more than doubled in the past ten years as machines and robots are learning to ‘see’ after being equipped with machine vision systems.

VDMA, a mechanical engineering industry association which represents more than 3,100 companies in the capital goods industry, forecasts that net sales will continue to rise by eight per cent to €2.2 billion in 2016.

In 2015, the industry posted year-on-year sales growth of 13 per cent in the German market. Among the global regions, exports to the rest of Europe held the greatest share of total sales, amounting to 23 per cent in 2015. The next largest share came from sales to Asia at 21 per cent, with China alone accounting for nine per cent of total sales.

In total, year-on-year growth in Asia was 19 per cent. North America showed a similarly high level of growth at an increase of eight per cent compared to the previous year. Together, the USA, Canada and Mexico accounted for 12 per cent of the total turnover.

‘Enabling machines and robots to practically 'see' is revolutionising automation around the globe,' said Dr Horst Heinol-Heikkinen, CEO of Asentics and member of the board of VDMA Machine Vision. ‘Demand is being driven by technology developed in Germany, for example, which is making a crucial contribution to quality assurance improvements in manufacturing or diagnostic tools in medicine. This development is reflected with outstanding figures for net sales and growth in the German machine vision industry - and the future prospects are excellent.’

The global trend towards automation in diverse fields and the digitalisation of industrial manufacturing (Industry 4.0) constitute drivers for the continued growth of machine vision. Broken down according to sector, the automotive industry remains the strongest customer worldwide, accounting for 22 per cent of total revenue. Machine vision revenue in this area rose by nine per cent in 2015.

The electronics industry - including semiconductors - was the second largest customer, accounting for about 13 per cent. Within electronics manufacturing, there was an increase in the demand for machine vision used in the quality assurance of high-grade products. In the area of screen and monitor production (TFT/FPD industry), there is a new generation of displays coming onto the market, demanding higher resolution quality and better data processing.

Non-industrial applications are making a significant contribution to the increase in sales in German-made machine vision, accounting for an average growth rate of 16 per cent per year from 2011-2015. Demand in transport technology, medical technology and logistics is actually growing faster than in industrial manufacturing. Large potential is also being identified in the agricultural sector. Overall, the prospects for innovation and growth are greater in the non-industrial sectors.

Looking towards the future, the industry anticipates that growth will increase by 15 per cent in Asia, 14 per cent in America and by five per cent in Europe in 2016. While Asia and America are clearly identified as the engines of growth, there is greater caution about developments in Europe. Relevant risks and opportunities include future developments in the price of raw materials, exchange rates and the effects of political crises.

Further Information: